WorldFirst is a London-based first-class and widely known specialist currency exchange provider established in 2004. Headquartered within the UK, they offer dedicated international money transfers across the globe. World First also serves individuals as well as businesses, such as providing various online e-commerce exchange and money transfer services.

WorldFirst works by prioritizing its customers, making a “Price Promise” to their patrons, providing them the highest-quality rates for their money trade. Their network ensures the provision of a customizable service to the people along with commercial enterprises consisting of advanced equipment such as the forward contracts. So for both smaller and larger amounts and overall making sure all matters run smoothly, they’re an incredible choice.

Pros of WorldFirst

Blindly trusting an enterprise with your money transfer work can be daunting. So we compiled a list of pros of WorldFirst that can lessen your fears. These benefits are:

Reliability & Security

Worry not within the UK with the aid of the FCA (Financial Conduct Authority), WorldFirst is constantly under regulation. According to FCA’s regulation manner, WorldFirst has to preserve its clients’ budget separate from its personal budget. This ensures the safety of your money, even if the business enterprise runs into any financial difficulties.

For an additional layer of security, the Two-factor authentication (2FA) is there. By applying two kinds of verification, only then can you log into your account. The two-step verification includes:

• Your personal password that you choose yourself.

• A new number is dispatched to you either through textual content or generated by an authenticator.

It is considered to be one of the most regulated businesses in the world. So you can trust them with moving your cash around the globe through banks. We endorse companies like WorldFirst for transferring more significant amounts due to the fact that they make sure your money is in safe hands.

Transfer Speed

Transferring GBP to USD or EUR with WorldFirst is usually delivered within one day. Also, transfers to states like Australia and New Zealand are generally delivered within 24 hours as well.

The real pace of transfer is determined by foreign money, the total amount, and the place where it is to be delivered. US dollars, GBP, and Euros are key currencies that can be delivered even within 24 hours. At the same time, exotic currencies may require up to four business days. The relationship managers can help you out if you’re looking for quick delivery.

No Hidden Fees & Charges

Opening or holding an account is free of cost. Yes, you’ve heard it right! No need of expenses to open or preserve an account with WorldFirst. All private or personal transfers are also free. For a business transfer, you may have to pay a small amount somewhere between $10 and $30, relying on your business’s quantity and volume. Even for transactions above $10000, you do not have to pay a dime.

WorldFirst maintains a policy of no hidden fees and charges. The countries you’re transacting between can, at the time, determine if you have to pay any additional charges. However, you should check with a nearby local bank at both ends that operate with WorldFirst.

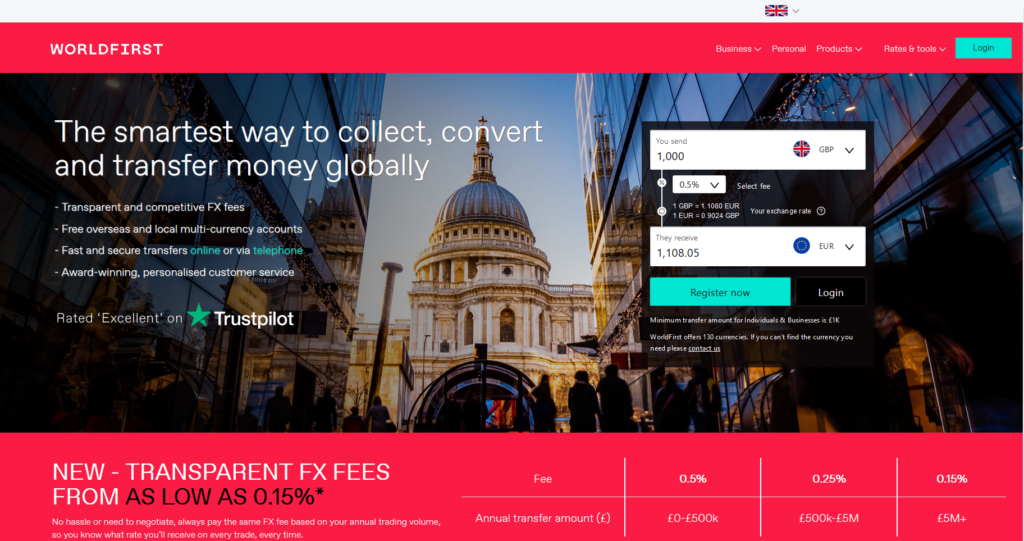

Competitive Exchange Rates

You can easily find highly competitive and transparent change prices offered to you by other enterprises. Customers can avail these rates that are generally not different from the interbank rate.

If you’re in the UK, you can even avail “up to 85% cheaper rates”. Their rates are the most satisfactory inside the market for larger amounts. Furthermore, for smaller amounts, they are very much competitive. Although they do maintain a margin for themselves, it is drastically lower than banks.

With their service saving up to 0.25% to 4% of the quantity, your transfer is possible. You can benefit from this enormously, relying on the total amount you are transferring. They offer even better rates if you are moving more significant amounts. Additionally, they also provide you with a great ‘price promise’ that is terrific for getting the best rate.

Cons of WorldFirst

After going through the pros’ list, you must be wondering if any challenges occur with using WorldFirst. Well here some drawbacks you can experience with using this service:

Delayed Transfer

As claimed by some customers, a concern is that they experienced a slight delay in receiving their funds within the promised time. However, WorldFirst issued a statement saying that this became an issue mostly because of delays at the financial institution’s end (banks).

Additionally, they ensured clients that the client’s funds are kept separate in their very own accounts. None of the funds are used in any part of the company’s working capital.

Troubles with Account Opening

Some clients have experienced difficulties with their account opening application. Their application was either rejected straight away, or the entire procedure was too hectic. Such delays could’ve occurred due to two reasons: compliance requirements or two due to any administrative lags.

Final Thoughts

WorldFirst is a reliable and efficient currency transfer service that we recommend for all large amounts of transfers you want to make. We hope to have answered all the majority of your concerns. You can try out WorldFirst without any hesitation for any money transfers work.