All the advancements in fintech are meant to bring ease and comfort in the daily tasks people practice. As life is getting faster day by day, it is becoming difficult and time-consuming to drive to places just for minor work. For quicker and better accessibility, almost everything is getting mobilized, and so does financial technology. Among all of them, the Currency Fair is another facility that has been set on your fingertips.

Founded in 2009, Currency Fair is the latest online peer-to-peer currency exchange marketplace that has evolved the whole concept of money exchange. Though it’s headquartered resides in Ireland, but it is successfully running in other states as well including the UK. For people who are new to this concept ans still conscious if to avail the services of Currency Fair or not, this review might help them.

Why choose Currency Fair?

You need to know about the services Currency Fair is providing and the benefits you will have in order to proceed with a positive mindset.

Comparatively inexpensive

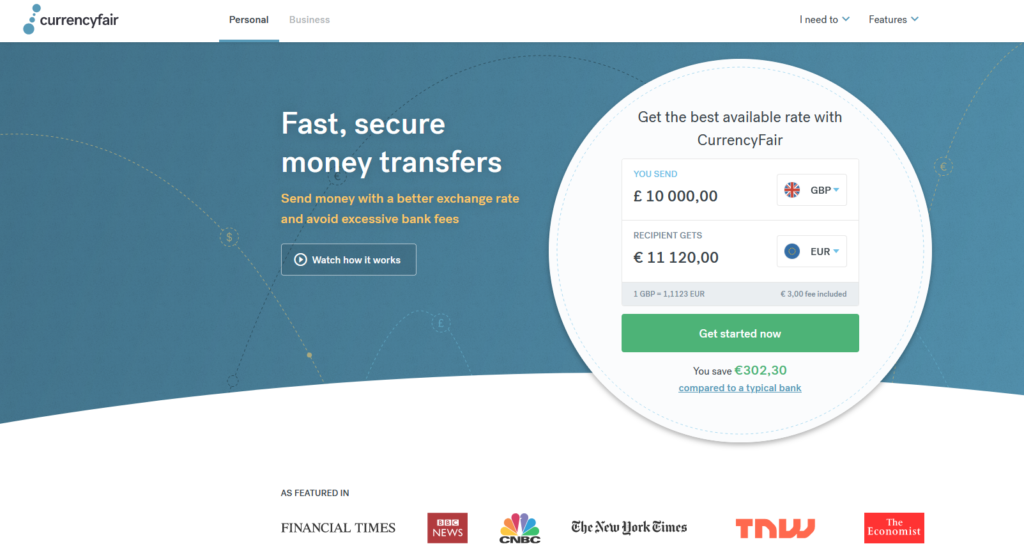

Consumers who get their currencies exchanged from Currency Fair, enjoy to pay fewer charges and exchange fee as compared to the other market places. New customers who are using its services for the very first time, can benefit from their beginner’s package of the first three free of charges exchange. Since it works as a peer-to-peer exchange service provider, it meant that it would match people who want to exchange the currency for the one that another person desires. This is the reason that transfer is inexpensive for major currencies.

Equally beneficial for individual and businesses

Either a common man needs an exchange, or a settled business requires it for trade purpose. The rules, operations and charges are all the same and reasonable for both to avail the service.

Fast Service

There are actually two ways to get an exchange. Either to directly send the money from your bank account to the Currency Fair account and it exchanges the payment for you automatically. Or you can top up the money or hold it in your Currency Fair account, and whenever you are ready, you can change your money for the other notes.

Safe and Secure

With Currency Fair, there is no threat of theft or fraud. It is a 100% reliable, safe and secure service for money exchange. Currency Fair is a regulated financial institution which is under the supervision of the Central bank of Ireland, this proves its position to be secure. It cannot take your money, neither it can invest it anywhere without your permission. And in case if they shut down their service and you are in the middle of your transaction, all the money will be returned back.

Why Do not choose Currency Fair?

There are few characters of the Currency Fair that might not be favourable to your needs.

Limited currency support

There is a limit on the exchange of currency. Usually, it does not allow a big amount in a single turn. So if you need to exchange a significant amount, i.e. thousands of dollars, it would probably ask you to submit additional documents for regulatory compliance.

But you can also use a short cut by exchanging money into turns.

Only support bank account

A major demerit of the Currency Fair is that it only supports bank account. Presenting real money to exchange will not suites it.

Only allowed within the state

Another drawback of Currency Fair is that it does not allow cross border exchanges. The money will remain in the boundaries before and after the transaction.