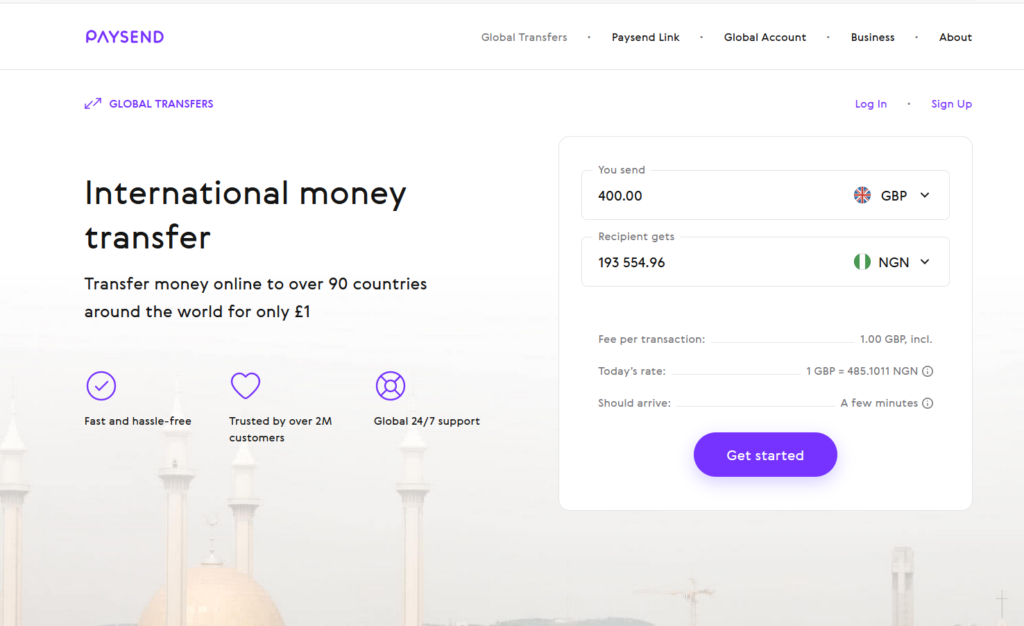

PaySend is a global financial transfer business enterprise. They allow their users to make broader card-to-card transfers. With this service, you can send funds to financial institutions, accounts, as well as digital wallets. Currently, PaySend serves more than 1.four million clients all across the world, with a network of over eighty countries.

The world is gradually becoming increasingly interconnected. In current times a need for efficient, fast, and cheap cash transfer services is on the rise. For the very reason, PaySend customers can now send cash to their recipients’ residing in remote places immediately. They can do by sending funds directly to their cards at fixed, affordable fees and mid-market quotes.

Pros of PaySend

We are listing some of the advantages you can make by using this money transfer provider to send money to family and friends or spend online in business.

Worldwide Reach

PaySend supports a global network. It offers transfer services for up to 84 countries spread across different continents, Europe, Africa, and beyond. The company is also seeking new markets to add to its existing network.

Affordable & Fixed Fee

As compared to what most providers charge, PaySend charges a low cost and affordable fee.

Security payment

Any payment by PaySend is certified and secured. The payment network on Mastercard, Visa, UnionPay, and others are all certified and regulated. Moreover, it is regulated by two different authorities:

1.The Financial Conduct Authority (FCA)

2.The Payment Card Industry Data Security Standard (PCI DSS)

24/7 Global Support

Since the money transfer customers 24/7, around the clock, support is invaluable. You can get customer support through live chat, email and telephone. On social networking sites such as Facebook, Instagram, and VK, PaySend has a team of specialists dedicated to solving your problems.

Numerous methods of transfer

PaySend allows customers to use various transfer methods. Transfer money from your card directly to either the recipient’s card or their bank account. Customers can even choose their preferred currency while transferring funds if the recipient countries allow them to receive money in more than one currency. Another simple option is to send money through the recipient’s phone number by using the Paysend Link.

Cons of PaySend

PaySend has some drawbacks to its service. While sending money via this platform, you may face the following disagreeable features:

Extensive review process

Some users complained about the submission of their documents. In the case of identity verification, PaySend takes a long process to review the customer’s accounts. However, you should keep in mind that the provider has to be clarified about your case. Their review process generally takes 3 hours or up to 3 days, depending on the significance of the case at hand.

Limited Sending Countries

While their coverage relatively composed of a worldwide network, but their delivery network is not as extensive. Users can only send money from 48 countries, mostly from Europe and North America. Most African countries are not present in the list of sending countries.

Infrequent Delays

At times, transfers do face delay. All deliveries don’t take place instantly. Gathered by the customer reviews, delays may occur from time to time. Some of them relate to the examination and additional verification.

If you’re looking to send money to foreign places, then PaySend is a viable option. Save yourself from an additional transfer fee and send money anywhere across the globe. With Paysend, you can ensure that your money will pass further. Knowing there’s a person who can aid you in the course of your switch can save you stress. Their team of experts is available 24/7 to help you every step of the manner. Try out this web platform that you can access via cellphone or out of your tablet.