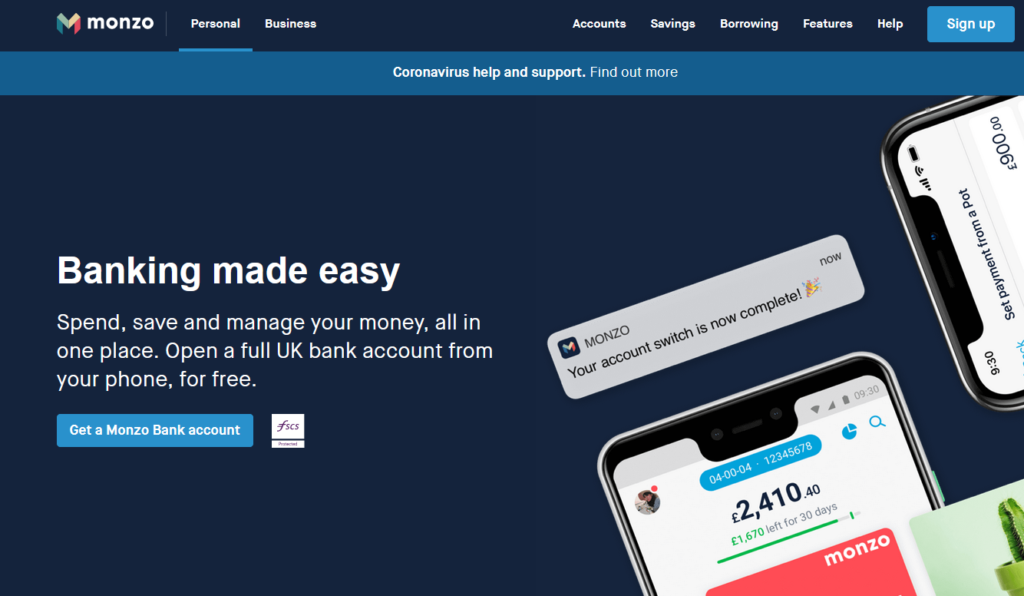

Monzo neo bank is one of the lead entrants in the fintech world. Its launch in the UK in 2017 is specially for the people adopting the digital solutions for their work and problems. Monzo has opened a gateway of smart handling of money for UK customers by managing every detail through the app. The smart banking solution allows you to save, spend, and manage your money all through your phone without any physical branch.

Pros of using Monzo neo bank

Banking facility at the tip of fingers

Monzo neo bank allows you to enjoy banking facility at the ease of your comfort without the hassle of physical branch visits. You can open your Monzo account within few minutes without any monthly fees or discomfort. If you are someone new to the UK, the Monzo bank account is the best idea to start your life in the UK.

Categorize spending

With Monzo bank account you can categorize your spending. It provides you with a platform to sort your salary by categorizing your needs and requirements. It is a great way to keep a record of your expenditure and fulfil the monthly requirements within your budget. You can even set your monthly budgets and saving goals with the help of Monzo.

Made travelling easy

With Monzo master card you can travel around the world without the fear of extra charges on exchange. You can pay for your shopping, accommodation and travelling with Monzo master card in any currency with no additional fees. In the European economic area, the atm cash withdrawals are entirely free. And for the other countries the cash withdrawal up to 200 euros/month are free and after that Monzo charge 3% of the total amount. Hence Monzo has eased travelling expenditure up to significant levels.

Drafts and loans

Although Monzo neo bank is not the type of traditional bank, but it allows overdrafts up to 500 euros and loans up to 3,000 euros. The borrowing facility of the Monzo neo bank is quite advance and not the traditional bank type. You can quickly get your loan without going through the list of forms. Monzo even let you to set repayment dates according to your convenience and allows flexible options for repayments.

Get your salary a day earlier.

If you are residing in the UK and get your salary by the bacs service, then Monzo benefits you in getting your salary a day earlier. You can add your salary to Monzo, and it helps you to get hands-on your hard-earned money a day earlier.

Money Safety

Although Monzo is an entirely digital bank but it is fully under control of the financial services compensation scheme. Therefore your money up to 85,000 euros is protected in case of bankrupt situations. Moreover, Monzo is four times better at minimizing card fraud and ten times better at stopping account hacking. Therefore, it is trusted by millions of users for their money safety.

Cons of using Monzo neo bank

No options for International payments

The Monzo account holders only possess a local account number and cannot receive any international payments. Only UK customers can benefit from it with domestic money transfers.

Customer care service

The customer care service is via in-app chat options or email. There is no in-person consultation of the problems faced by the customers related to their bank account.

Final thought

Monzo is an excellent option for the UK customers. It can serve as an only bank account because it can fulfil every basic banking need required for the person to live in the UK. From paying bills to categorizing spending, it is the best option for an individual.