Pleo has stood its way out in the fintech world by providing smart solutions to the businesses. It aims to automate finances and providing money management facilities to the businesses. Pleo corporate card has provided a new perception of managing employees and business budget only through an app.

What does pleo do?

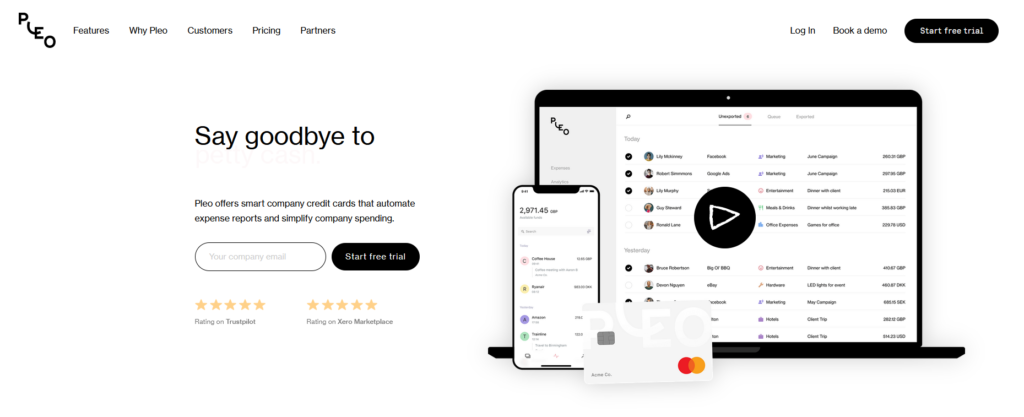

Pleo is directed to manage company expenses. It allows its users to keep a look at their employee and company budget and spending just through an app. Pleo markets itself as a smart solution for business financing by automating it through more straightforward means.

The work of pleo

Pleo works entirely through an app. The app keeps the record of business budget, financing, bookkeeping, and data recording. It also helps your business by making better decisions. The platform works by providing the following services to its customers:

Card distribution

Pleo allows you to distribute cards among your employees to manage expenses on the company’s behalf. You can include as many employees as you want to assign the card and keep track of their activity through your smartphone.

Spending limits

You can set rights and limitations on the spending limit of pleo card for every employee. The work of your employee will be dependent upon your customization and your choice. The limits can be adjusted according to the requirements.

Integrated accounting

Pleo has obliterated the lengthy paperwork of accounts reconciliation by handling it smartly. Hence, you can connect your accountings software with pleo and get the app work for you.

Quick and free reloads

Pleo allows you to top up your wallets and cards without any extra fees. It works the same as a debit card. Regardless of the number of cards, top-ups will be done from your account balance quickly and easily.

Fraud detection

Pleo has the audacity to detect any suspicious transmission or purchases. It helps your business to be safe from any fraud or illegal activity. Therefore the app immediately notifies of any suspicious activity going on your account or card.

Customer support

Pleo aims to provide you with the customer care service via in-app chat options, emails, or via phone as well. The team responds efficiently to all sorts of queries and problems.

The cost and limitations of pleo

Pleo offers an essential subscription for 6 euros and pleo plus 10 euros a month. The pleo plus has certain extra advantages over crucial. Regardless of the subscription fees, pleo also charges fees for certain features, for example, it charges extra 2.5 euros on card replacements, 4 euros on withdrawals internationally as well as domestically, moreover, customer refund can cost you up to 25 euros.

Safety with pleo

Pleo understands the value of your company’s data and information and therefore protect everything via standard encryption. The details of your finances and accounts are behind the password of your choice. And lastly, it also aims to rule out any malicious attacks on your account and finance.

Pleo in a nutshell

Pros

- Easy and fast signup

- Well designed and PRA and FCA registered

- Automate finance and integrates accountings

- Great customer support

- Multiple card option and quick top-up

- Safe and secure

- Multifunctional app

Cons

- Higher subscription fee than other challenger banks

- Additional fees on specific features.

- Extra charges for withdrawals domestically as well as internationally

- Larger companies can suffer drawbacks from per-user pricing.

In summary, pleo can be a great benefit if you run a small business in the UK, Sweden, Germany, and Denmark. It will be an effective alternative to traditional business banking. But it would be best if you consider your business and every facts and figure of pleo before opting it as your business management idea.